We have all heard about cash flow management. Do you maintain that while running your business? Even if the business is small, we should focus on cash flow management and enjoy the numerous benefits it can offer.

In this post, we will try to give you an overview of the cash flow management strategy in the US, the benefits it can offer, and tips that will definitely help you. If you search sales tax attorney near me on Google, you can easily get a number of contacts that will help your business do tax returns and handle difficulties.

Every business follows systematic steps like business monitoring, data analysis, and more to manage its cash flow. Once you keep reading, you will eventually learn many more aspects about it and implement it for your own business.

Why Businesses Must Focus on Cash Flow Management?

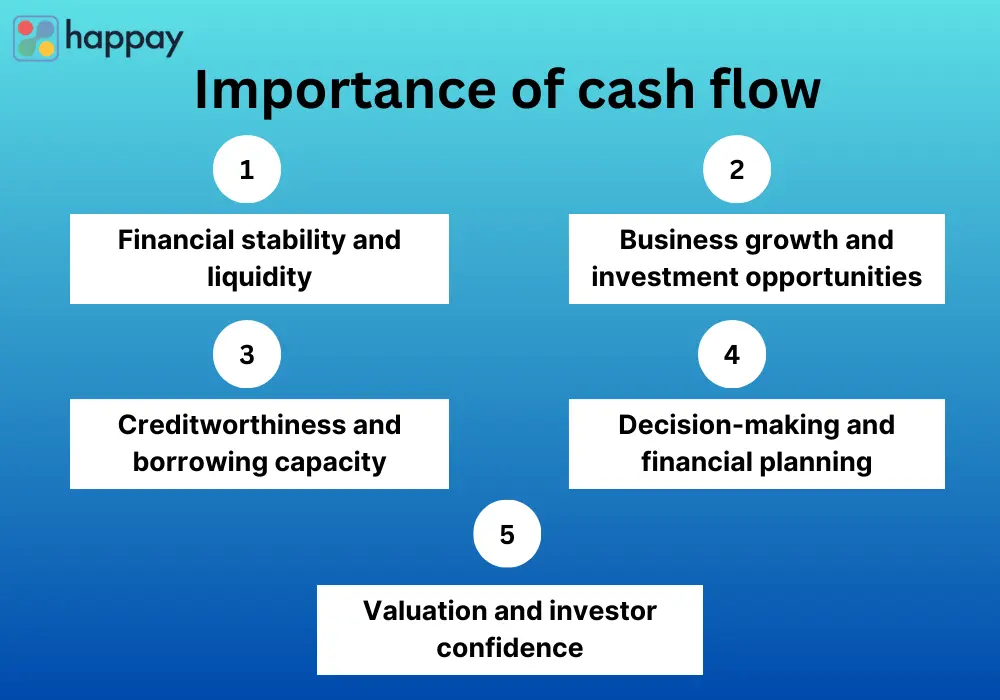

We have already told you that cash flow management is beneficial for any business, but how? Here are some of the reasons behind it-

- To Have a Stability in The Business

If you don’t track the cash flow in your business, it is not possible to have stability. Mismanagement in finance will eventually create distress in the organization and ultimately create the downfall.

- Managing Risks Will Be Easy for You

Risk management is something hugely important for running a business successfully. When you are effectively managing the money, it is possible to predict a cash shortage situation and address that boldly.

- Have Enough Liquid Money

Liquid money is important, especially if you are running a retail business. When you have sufficient cash in your hand, it will help you pay bills and more.

- Great Opportunity to Grow Your Business

For any business person, the aim is to grow the business. Cash flow management will help you with investment options and create growth opportunities. You can easily expand your business and make new outlets of income. Consulting with a tax relief lawyer in Los Angeles will help you in this process.

Cash Flow Management Process

As you already know the importance of cash flow management in any business, it is time to learn about the process of cash flow management.

- The first order of business will be monitoring your current situation. Fortunately, modern cash flow digital tools are effective in monitoring and other aspects.

- Try to understand the strategy the business has been following so far. It will help you learn about the trends and possible mistakes.

- Predicting cash flow is difficult, but those who want to have a significant advantage need to look at the data and make the prediction as accurate as possible.

- Invoice management has become easy now with the use of modern software.

- Build a working capital that you will use to manage the daily affairs of the company.

- Have enough cash reserve so that you don’t tremble in difficult times.

- Discuss with all the employees in your business to find other ways as well.

Most business organizations are following the same method to manage their cash flow. We hope you will see significant growth in the coming years. Don’t forget to consult with an expert to learn more.