What is the Fair Credit Reporting Act? The Fair Credit Reporting Act, otherwise known as FCP, serves as the cornerstone for safeguarding consumers’ rights and privacy relating to credit reporting. This FCRA, enacted way back in 1970, but also further amended a few times over, is essentially the tool that dictates the fairness, accuracy and privacy of the files of consumer reporting agencies(CRAs). This manner ensures that individual consumers are provided with the liberty to either approve or refute whatever information appears on their credit reports. Grasping this is crucial for the person that need to decidise which way he/she should make his/her credit report.

Access to Credit Reports:

Fair Credit Reporting Act lawyer ,, The FCRA guarantees the consumers the right to a free report annually for each of the major CRAs – Equifax, Experian, and TransUnion – that is specific to them. Moreover, credit bureaus must offer a free credit report to a customer if the denial of credit, job, or insurance for such individual has been a result of any such report information. This data becomes more accessible to consumers who can read through these credit reports, cross-check their accuracy, and spot any anomalies or credit fraud.

Dispute Process:

In case of any bed information or differing details being found in the credit reports as given by CRAs, consumers have the right to contest such that and with the responder entity (which providers the wrong data) as well. The FCRA obliges the CRA to launch another investigation within 30 days if the disputed items still exist. The data will be regarded as inappropriate if its accuracy question is raised, upon which the CRA will have to rectify or erase it. To begin with, consumers have the privilege to ask the credit reporting agency to inform the intended individual, who had the credit report in the last six months prior to, on the discrepancies or the alterations.

Protection Against Identity Theft:

Identity stealing is still a huge issue for the loyal customers online in the current century. The FCRA (Fair Credit Reporting Act) elucidate on several safeguards to assist victims of identity crimes in restoring the damage caused by criminal acts. When defaulters see the fake activities on their credit files, they have the legal provision to make a fraud alert or a lawful freeze in order to prevent the payment from being taken. A fraud alert fames creditors to take additional measures when verifying the identity of a person during credit applications, while a security freeze makes it hard to give access to the credit report which would make it hard for identity thieves to open new accounts in the victim’s name.

Limitation on Information Disclosure:

The FCRA also to an individual’s accessing his / her credit information and limits the personal and commercial use of that information. Only authorized institutions are allowed to demand a report from credit consumers, these such as lenders, insurers, employers and house-owners. On top of that, there is a need to get the consent of the individuals whose data are accessed for such activities as employment and insurance. Such restrictions will not only protect private information of the customers, but will also block unauthorized individual from reading your credit information.

Right to Opt-Out of Prescreened Offers:Right to Opt-Out of Prescreened Offers:

Consumers should be assured the privilege to choose whether they would be earning prescreened offers of credit or insurance, made available to them from info in their credit reports. These are mainly the results of the work of CIRs and insurers who are are selected by definite criteria. One of the ways the consumer can reduce the number of solicited mail and offers arriving at his/her house is to choose an option number of prescreened offers where they are screened before presenting to the consumer.

Enforcement and Remedies:

If the Fair Credit Reporting Act (FCRA) is violated, consumers can:

File lawsuits against credit reporting agencies (CRAs) and businesses that provide information to CRAs Obtain compensation, including:

Actual losses suffered, Fixed damages set by law , Legal expenses, Retributive damages in cases of deliberate violations Government agencies, such as the Federal Trade Commission and the Consumer Financial Protection Bureau, monitor and enforce the FCRA. They investigate violations and take action against offenders.

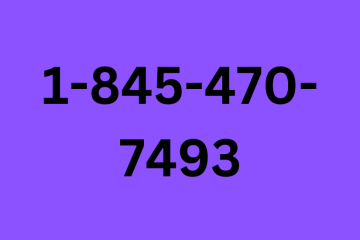

Consult out FCRA Attorneys

Contact our Florida Fair Credit Reporting Act Attorney at The Law Offices of Jibrael S. Hindi to protect your rights and navigate the complex landscape of credit reporting.